On the State of P2P Cash

As we approach the 12th anniversary of the Bitcoin White Paper, it’s worth asking ourselves: How far along have we come in the search for p2p cash? Have we been good stewards of Satoshi’s dream for a “purely peer-to-peer electronic cash?” Or have we fumbled the mission?

In order to address this, we must first ask ourselves: What was Satoshi’s dream?

What is Bitcoin?

Bitcoin is as Satoshi said it was: “A purely peer-to-peer version of electronic cash [which] would allow online payments to be sent directly from one party to another without going through a financial institution.”

If Bob buys something from Alice’s book stand at the local flea market, he’ll physically deliver payment to her. On the other hand, if Bob wishes to buy something from Alice’s website or conduct any other transaction in which they are not face to face, Bob & Alice must hire a third party to verify both the transmission & receipt of funds. Common providers of this service like Visa, banks, & payment processors such as PayPal & Venmo, have become household names.

The addition of a third party necessarily increases the cost of the transaction, which thereby renders what Satoshi called “small casual transactions” impossible. Moreover, if one party disputes the transaction, the trusted third party must of course provide mediation, increasing transaction costs still, & thus making truly irreversible transactions impossible. Worse still, is that the need for third parties opens the door to government intrusion. While it would be nearly impossible for the state to interject itself into every exchange where the transactors are not face to face, it’s much easier to force a small handful of these trusted third parties into compliance.

Satoshi’s brilliance was in shifting responsibility for third party verification away from centralized institutions to a distributed network of miners. It’s in this way that Bitcoin is able to disintermediate government regulations. Furthermore, as long as honest nodes retain more computing power than dishonest nodes, the network will remain secure. Thus, the state would have to garner +50% of the network’s mining capabilities to disrupt Bitcoin – a feat they have thus far been unable, or unwilling to achieve.

Armed with this preliminary understanding of Satoshi’s vision for p2p cash, we can now begin to assess how far along the road we’ve traveled, and if perhaps, we’ve made a wrong turn somewhere along the way.

As you’re probably aware, the blockchain community has since splintered into a thousand pieces, each with their own competing coins & unique attributes. Although some argue that this splintering has delayed mass adoption, I believe it’s a healthy evolution of sound money, in strict accord with F.A. Hayek’s landmark Denationalization of Money.

Let’s take a look at some of the strongest branches the tree of Bitcoin has produced.

BTC

One of the issues with Satoshi’s original design is that small blocks can congest the network, thereby driving transaction costs up & making those “small casual transactions” impractical. Several solutions were proposed to alleviate network congestion, but the community failed to reach a consensus. This ultimately resulted in the 2017 chain split that left us with two iterations of Bitcoin: BTC & BCH.

One way to scale a blockchain without increasing the block size is with the addition of bidirectional payment channels, such as the Lightning Network. LN allows two parties to fund a channel and transact off-chain until that funding limit is reached. When either party closes the channel, all transactions are then verified on-chain.

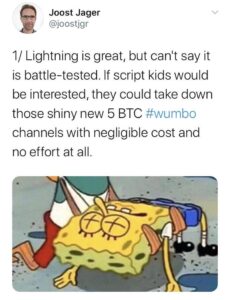

Lightning Network (LN) is an important development that helps BTC retain Satoshi’s mission of p2p cash, but it is not without fault. Note that all LN transactions occur off-chain. While LN employs other cryptographic protocols, they were not designed by Satoshi Nakamoto. Recently, this has been brought to the forefront by developer Joost Jager who found a bug in the recently developed Wumbo channels.

That the term wumbo is derived from an episode of Spongebob Squarepants is fitting, as neither the cartoon nor the Wumbo LN channels should be taken seriously. Currently, LN channels have a capacity of .16777215 BTC & individual LN payments can be no greater than .04294967 BTC. Needless to say, this is unlikely to help BTC achieve mass adoption. To it’s credit though, Wumbo is an attempt to right the ship. Wumbo channels remove the individual spending limit & the channel capacity. Unfortunately, as Joost has made clear, these channels have thus far proven insecure.

It seems that the market agrees with my less than enthusiastic assessment of BTC’s Lightning Network. To date only ~$12M in BTC is locked in LN channels whereas Ethereum holds an impressive ~$420M.

Note that none of this takes into account the ethical considerations facing Lightning Network. Deterrence punishment, a violation of the non-aggression principle, is inherent within so-called justice transactions. If for example, a dishonest node attempts to steal half of the funds stored on a LN channel, then ALL of the funds will be transferred to the honest node. The idea is that this sort of deterrence will help prevent fraud. However, honest nodes can and almost surely have lost funds through these “justice” transactions. It is indeed true that participation in LN channels is voluntary, but how many of those who’ve lost funds would agree that the contract was properly executed? My guess is none…

There are a heap of other concerns with BTC’s lightning network, such as watchtowers and routing issues, but at this point it feels like beating a dead horse. In short, Lightning has thus far been unable to satisfy Satoshi’s dream for p2p cash.

BCH

The second iteration of Bitcoin produced by the 2017 chain split is Bitcoin Cash. Bitcoin Cash is a modest attempt to increase the block size from Satoshi’s original design to 8MB. This means a lot less network congestion, which in turn produces extremely fast transactions with negligible costs. Crucially, all BCH transactions occur on-chain & thus are govened only by the Nakamoto Consensus.

Bitcoin Cash also strictly abides by the Mengerian framework for monetary theory. With cheap, rapid transactions, BCH satisfies the primary function of money as exchange media. Also, by preserving the p2p nature of Bitcoin, BCH satisfies the use-value requirement of Menger’s Regression Theorem. This means that BCH is well positioned to become a general medium of exchange, or in other words, money. For more on this, see this article.

BCH is of course, not without detractors. Supporters of BTC claim that bigger blocks make running a full node cost prohibitive and can lead to centralization. I often wonder how many of these detractors are themselves running a full node on the BTC network. Moreover, as BCH adoption increases, merchants are increasingly likely to run nodes, as they already have an obvious incentive to verify transactions.

BCH ABC

Recently, a schism in the BCH community has erupted over the best way to fund the development of infrastructure. A small group of developers led by Bitcoin ABC believes the best way to accomplish this is by siphoning off 8% of coinbase rewards & redirecting those funds into their own pockets. For a detailed explanation as to why this is a horrible idea, see this article.

In short, it seems BCH-ABC is destined to fork itself into obscurity. If I’m wrong and ABC succeeds, it’ll be the first time in monetary history that a currency’s infrastructure was developed by a centralized entity & not entrepreneurial market forces.

By moving from peer-to-peer cash to peer-to-ABC-to-peer cash, ABC utterly fails to preserve Satoshi’s dream. Indeed, they’ve fallen flat on their faces before the fork has even occurred.

Dash

By enabling fast and relatively free transactions, Dash successfully preserves the p2p nature of the White Paper. Like ABC, Dash has a built-in infrastructure funding mechanism. However, rather than relying on one firm, decisions are made by a distributed network of masternodes, thus allaying any fears of centralization. Further, masternodes are required to stake a significant amount of Dash, thus ensuring that their interests are aligned with the currency’s.

Dash’s private send feature – essentially, a free, built-in coin mixer – helps ensure fungibility, an important element in the quest for sound money. However, according to a recent Chainanalysis report, less than .7% of Dash transactions utilize the optional private send feature. Not to worry – as the state becomes increasingly oppressive, we can expect to see this number rise significantly.

In short, Dash is a vital piece of the p2p cash ecosystem and a great option for agorists everywhere.

BSV & Nano

BSV & Nano enable fast and virtually free transactions, and thus have the makings for excellent p2p cash. However, both currencies have room for improvement, particularly in terms of adoption. The lack thereof places a serious barrier on sending and receiving transactions. In the case of BSV, strong personalities have led to some exchanges like Binance delisting the currency entirely. Moreover, a strong statist influence pervades the BSV community and welcomes, even invites, state intrusion – thus negating the p2p nature of Bitcoin.

Conclusion

Bitcoin and cryptocurrencies in general, are defined by their p2p nature. This single, often overlooked trait is how cryptocurrencies satisfy the use-value requirement of the Regression Theorem, how they will achieve mass adoption, and how they will end the fiat monetary system. Although there are a number of promising projects underway in this regard, currently only Bitcoin Cash & Dash seem poised to bring Satoshi’s dream to fruition.