Global Adoption of CBDCs and the Agenda to Destroy Private Money

It’s something that most involved in cryptocurrency are aware of — the exponentially quickening global move toward nation-states adopting central bank digital currencies (CBDCs).

However, there are many individuals in mainstream culture that have no idea just how far this technology has progressed, or just how devious the agenda behind it is. Even some in agorist circles may be unaware of the shocking degree to which private finance is being denigrated and destroyed, and a surveillance-based, violent, globalist economic panopticon ushered in.

In giving a summary of the current state of affairs, I hope to help such individuals from both camps learn more about the topic, and also inspire them to take action and beef up their supplies and private finances, in view of what is coming down the pike.

Digital Fiat, Privately-Issued Cryptocurrencies, and Classic Fiat

Central bank digital currencies are often spoken of by regulators and politicians in the same context as privately-issued cryptocurrencies like bitcoin. However, there’s a huge difference between, say, China’s digital yuan, and bitcoin cash, bitcoin, dogecoin, litecoin, ethereum, etc. If the United States finally makes good on talk of creating a digital USD, it will be nothing like bitcoin. While distributed ledger technology (DLT) and blockchain technology may still be used for central bank digital currencies, the money is centrally issued, managed, and controlled. This is different from privately-issued cryptos that no state can touch, outside of the application of brute force and violating people until they give up their property, private keys, or passwords.

Classic fiat money is already almost completely digital itself, with the paper stuff in your wallet making up only a small percentage of circulating fiat supplies. It has been estimated in recent years that only around 8% of the world’s money exists as physical cash. The difference between the classic fiat today — of which the physical form is by and far the most private — and a CBDC is that central bank digital currencies come with programmability baked into the money itself. Smart contract capabilities mean that a CBDC system would be able to tax people, distribute or withhold payments, and issue financial penalties all in a centralized, automated fashion, all by way of the money itself. For a visual, imagine a dollar bill in your wallet that knows you didn’t pay taxes last year, and burns half of itself away. This is the type of thing we are discussing when discussing “smart money” or CBDCs.

Politicians, central bankers, and regulators laud the idea of CBDCs and even cryptos like bitcoin at times, due to the transparency they provide. As anyone in the bitcoin world knows, it is far from being a private money in and of itself. The Bitcoin blockchain shows each and every transaction, and all transactions that have ever happened on the protocol, and forensics technology grows stronger every year. Still, with privately-issued cryptocurrencies, there is no centralized control as with CBDCs, and there are myriad ways to obfuscate transactions. This threat to centralized power is why we now see world banks and powerful regulators attempting to co-opt private crypto.

One recent example is the European Union’s proposed legislation to ban anonymous wallets and “ensure full traceability” of cryptocurrency transfers. Where the state doesn’t have the tech to compete with things like bitcoin, they bring out the clubs and guns and threats, of course. Echoing this push for control are comments from a Central Bank of Brazil director this month, saying:

“The names of those involved in cryptocurrency operations will be known end-to-end. I can say that anonymity will not be an option.”

Regulators in the U.S., such as the SEC, are singing a similar tune, and now have their sights set on sapping defi (decentralized finance) of its utility in typical parasitic fashion. What will be replacing all these wonderful “Wild West” technologies that are actually helping common people out of poverty, and to improve their lives? Why, CBDCs, of course. The European Central Bank, for its part, is already working on a digital euro. But how many other statist entities globally are pushing for the same? The answer is: a lot.

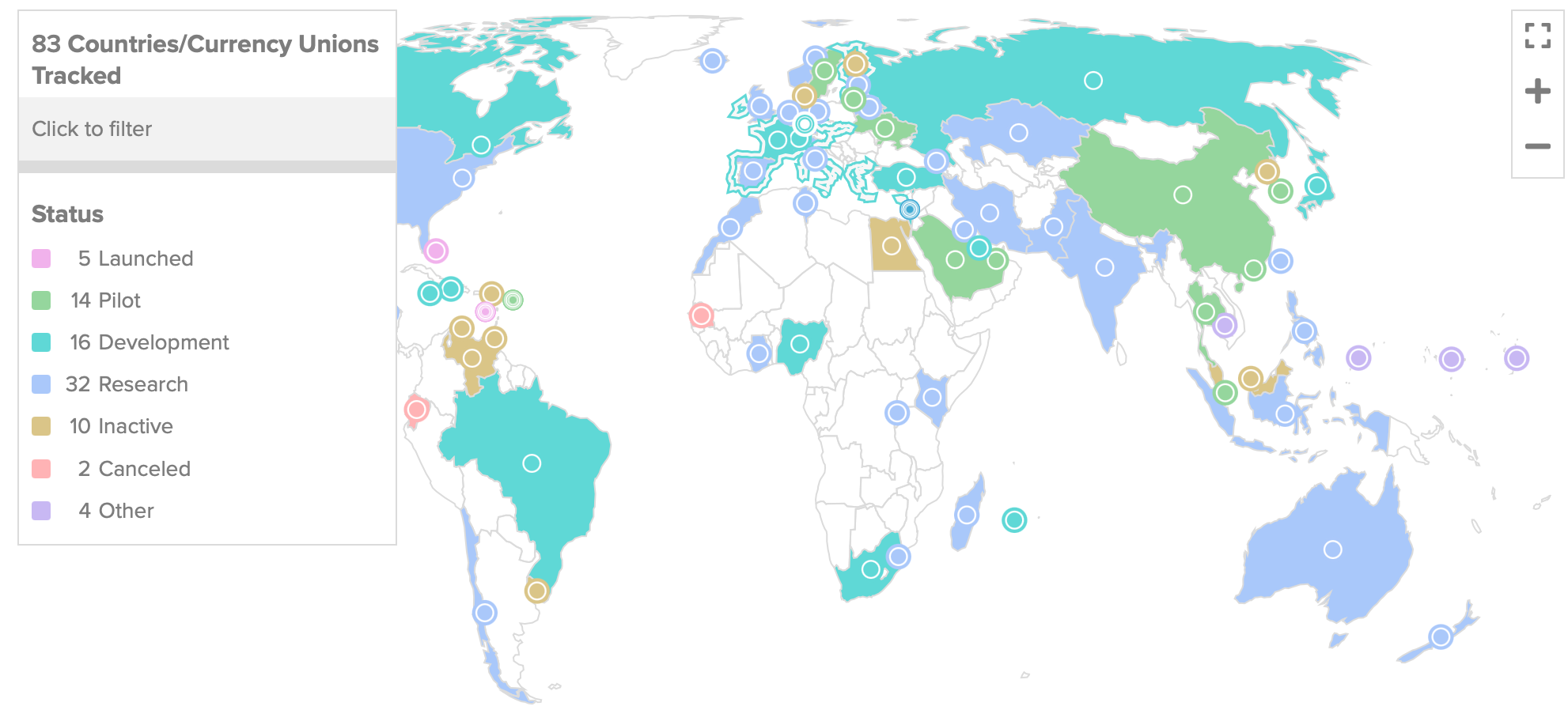

81 Countries and Counting, Over 90% of Global GDP Moving Toward Central Bank Digital Control

As the Central Bank Digital Currency Tracker at the Atlantic Council reports: “81 countries (representing over 90 percent of global GDP) are now exploring a CBDC.” Five countries have already deployed their CBDC, with communist China by and far having the most advanced and widely-integrated system for the digital yuan, or e-RMB.

China. That is the model that other governments are openly seeking to emulate and create.

Though U.S. talking heads like Fed Chief Jerome Powell are careful to insist that a Chinese-style economic surveillance system wouldn’t fly in the U.S., the creation of a digital dollar would result, all the same, in similar “social credit score” type ramifications if introduced. For example, let’s say you have yet to heed Joe Biden’s warning about his patience wearing thin, and you have not yet gotten the so-called covid vaccine. A programmable, centralized digital dollar — which is already in the works — makes it very easy to simply render you “unpayable” as physical cash is fazed out, and private use of other cryptos made illegal. As Powell has said:

“You wouldn’t need stablecoins; you wouldn’t need cryptocurrencies, if you had a digital U.S. currency”

Aside from the five CBDCs already launched, “14 other countries, including major economies like Sweden and South Korea, are now in the pilot stage with their CBDCs and preparing a possible full launch,” the Atlantic Council site notes.

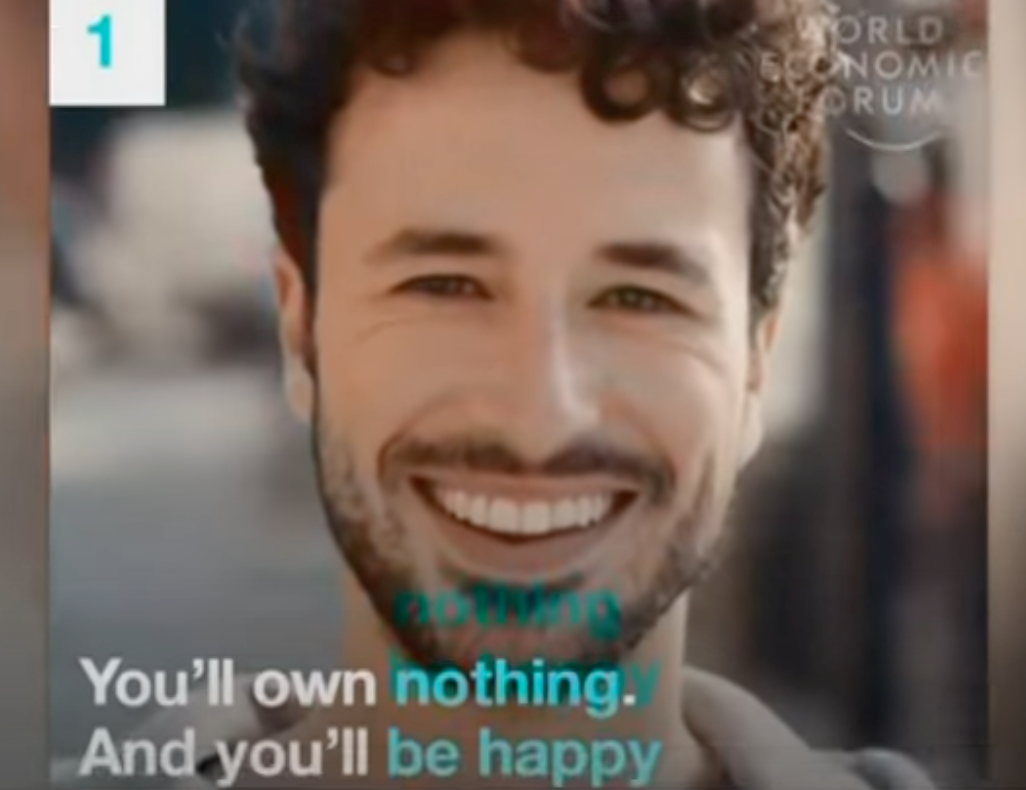

By and far one of the biggest and most oft-voiced justifications for this move away from private cash is the current so-called “global coronavirus pandemic.” It is indeed a virus of the crown, as the motivations for the move away from more private systems of money to complete feudalistic control of monetary power are clearly seen in the World Economic Forum’s ‘Great Reset’ agenda.

As Josh Lipsky, former senior advisor at the IMF (International Monetary Fund) has commented: “Before Covid, central bank digital currencies were largely a theoretical exercise. But with the need to distribute unprecedented monetary and fiscal stimulus around the world, combined with the rise of cryptocurrencies, central banks have quickly realized they cannot let the evolution of money pass them by.”

A Clear Motive for Financial Domination

So what would be the point of a mass-surveillance, fourth industrial revolution paradigm where economic privacy is demolished, individuals are atomized, and a digitalized global state fully takes over the economies of the world? How would it serve those in power to destroy whole economies and incapacitate work forces, making them fully dependent on the state for their money, as opposed to being productive innovators and laborers, independently saving, growing, and trading? Well, in some sense, the answer is in the question.

Looking at things zoomed out, the motives for the proliferation of CBDCs is crystal clear to see. From the horse’s mouth, automation has made traditional labor and production of goods increasingly unnecessary. As such, it no longer makes sense for the population-control-obsessed sociopaths in the state to grant the livestock as much free-range activity, as this potentiates disobedience and loss of control. As freedom activist Barry Cooper recently elucidated in a Facebook post:

“Now I realize the freedoms we had were not given to us out of decency but out of control. They gave us those freedoms to make conditions optimal for the slave forces to work in their factories, offices and fields. Now they don’t need billions of strong slaves because they have ushered in the Fourth Industrial Revolution. Technology can control us now so they no longer need to give us freedoms to get their shit done … Fifty years from now the new world will look a lot like China.”

Combine this vision of automated servitude, with a need to finally escape economic reality. The incomprehensible, astronomically massive debt bubble that has been created over the past decades (centuries, really) will not magically vanish. One can print money forever, but one cannot print resources forever, and at some point, physical reality always shows up at the doorstep.

By demolishing the debt record and putting individuals completely at the mercy of a centralized feeding trough for value distribution, whilst simultaneously divesting them of any and all private property, and making sound currencies illegal, there will be no more way to hold those in the state to account, or even to see their lies made transparent. Currently, my crypto tells me that fiat money is broken. My gold shows me clearly the dollar’s loss of purchasing power. Once that crypto is commandeered by the state, and the gold is ripped away, there is no more reference point.

The hard assets of the world, especially land, are currently being hoarded and bought up by governments at unprecedented levels. Once this New World Order has completely locked down hard assets, gold, crypto, and real estate, there will be absolutely nothing the average peon can do but gravel before the god of government and ask for another paltry squeeze from the digital teat. This is also why there is such a strong push to disarm individuals all around the world.

To drive the point home here, look at this quote about the pesky reality of people not spending when banks apply negative interest rates to stimulate the economy:

“If everyone is holding cash, negative interest rates become useless.”

That line was uttered by former People’s Bank of China (PBOC) governor Zhou Xiaochuan in 2017. In a January 2020 paper published by the European Central Bank, the same “problem” was discussed. “By allowing to overcome the zero-lower bound (‘ZLB’) and therefore freeing negative interest rate policies (‘NIRP’) of its current constraints,” the paper states, “a world with only digital central bank money would allow for – according to this view – strong monetary stimulus in a sharp recession and/or financial crisis.”

In other words, when people start putting their money in the mattress because they sense danger in the banking sector, negative rates don’t work anymore to prod them into pouring it back into the debt-based economy to uphold the illusion of prosperity. If physical cash and privacy are removed, the negative rate can be applied directly to the programmable CBDC, and that pesky “zero bound” can be made meaningless.

Zero, in economics, is supposed to teach us something. Teach us where there is a lack, and when it is time to readjust, slow down, work harder, pay off debts, and save. The magic of the new Modern Monetary Theory, however, doesn’t buy all that. As Reserve Bank of New Zealand governor Adrian Orr says: “Let’s tax cash holdings, simple as that: we’re back to monetary policy as usual; people are disincentivised to be holding large lumps of physical cash; they are having to think harder about putting money to work.”

How to Fight Back

As much as it would help this whole exploration to dive further into why the supposed measures to stop a mysterious virus from proliferating are propaganda, and to also corroborate the connection between the financial planners and those advancing what can only be described as a modern social eugenics agenda, there just isn’t time or space now, and it would take us away from the central topic of CBDCs.

In a nutshell, my personal view on how to fight back against this Orwellian push for complete societal control is simple. Keep yourself in rice, sound money, sound community, and defended. To quote John Galt from his famous speech in Ayn Rand’s epic novel Atlas Shrugged:

“Do not help them to fake reality. That fake is the only dam holding off their secret terror, the terror of knowing they’re unfit to exist; remove it and let them drown; your sanction is their only life belt.”

“If you find a chance to vanish into some wilderness out of their reach, do so, but not to exist as a bandit or to create a gang competing with their racket; build a productive life of your own with those who accept your moral code and are willing to struggle for a human existence. You have no chance to win on the Morality of Death or by the code of faith and force; raise a standard to which the honest will repair: the standard of Life and Reason.”